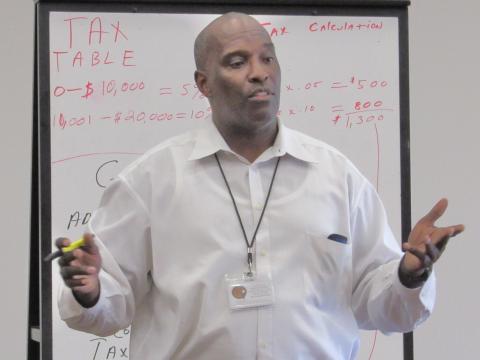

About a dozen dedicated young people recently completed a five-part course in Financial Literacy 101 taught by Soboba Tribal Administration’s Financial Analyst Lenell Carter. The most important lesson they learned is that you are never too young to learn about how to create a healthy financial future.

“My financial literacy skillset was noted during my interview process over two years ago but due to COVID the class was delayed,” Carter said. “Tribal Council decided that as we were coming out of the pandemic, we would be able to move forward with the course.”

Carter brought a unique perspective to his presentations, having experience teaching similar financial literacy classes for other Southern California tribes.

“I feel good about the material and I want the participants to feel my passion about this subject matter,” Carter said. “I tell them my story and let them know that ‘I didn’t know what I didn’t know’ about the topic of personal finances even after graduating with an accounting background. I was once like them and needed to find the resources to help me navigate these topics, alone.”

Each participant received a “Building Native Communities, Financial Skills for Families” workbook by First Nations Development Institute and Oweesta, who created the curriculum to “enable community members to realize their traditional values by learning financial skills that will help each person make informed financial decisions for themselves, their family, and their community.”

“The reason I like this book is that the format goes through some of your history and how your ancestors used financial literacy,” Carter explained during the first weekly class. “The beginning chapters are about how your ancestors used (traditional) resources that were available to them, like acorns. That is financial planning in a nutshell.”

The introductory class on May 12 outlined why it is important to plan things out and be aware of factors in this consumer world we live in that affect each person differently, based on their circumstances. Carter encouraged each student to develop short- and long-term goals, even non-financial ones, and not to lose sight of them.

“What you learn at your age will really benefit you,” he told them. “When you turn 18, you will either be victims or have the knowledge and education to survive and thrive. At that age you won’t have a lot of credit built up and won’t be able to get a lot of things on your own. But there are a lot of organizations and individuals out there who will try and persuade you to buy things and you don’t want to go into debt.”

He said that decisions made now can affect their financial future through credit ratings, which is why it is critical they remain mindful when spending money. He admitted to having a terrible credit score when he graduated from college because he wasn’t taught the life skills he needed to know to manage his personal finances. Carter explained that a credit score is like a report card, but it stays with you the rest of your life.

“The Credit Cycle is a large topic and as I explained the use of credit scores and interest rates, the group did perk up because they knew they could save real dollars on purchases,” he said. “The five Cs credit is based on are capacity, capital, character, collateral and conditions.”

Tribal Controller Ken Alfaro was invited to one of the classes to discuss budgeting for the tribe and how it translates into everyday life. Sarah Merritt, branch manager of the American United Federal Credit Union at the Soboba Reservation, was a guest speaker on a class about using financial services tools to help navigate day-to-day transactions and using them to help a person achieve their short- and long-term goals.

“Sarah was great,” Carter said. “She emphasized personal service to members, and she provided a plethora of information on the actual services the branch offers to the community.”

Another advantage to hearing from Merritt is that all participants who completed the course received a $50 voucher from the credit union to open a savings account there, which was matched by Soboba Tribal Council with an additional $50 to help them jump start their own financial future. They also received a $25 incentive from Soboba Tribal TANF.

Vice chairwoman Geneva Mojado provided encouragement to the participants at the first session, as did Tribal Executive Officer Steven Estrada.

“We want you all to build a strong foundation and venture out, go to school, meet new people and see the world,” Mojado said. “Ask questions and let us know what else you want to learn about. This is a pilot program and we might possibly make it a requirement in the future. Being the first ones in it puts you ahead of the game. There is a lot to learn so be proactive in making the right decisions and stay headed in the right direction.”

During the program, Carter discussed income, expenses, budget, savings (both long- and short-term) and taxes. Active participants throughout each session were rewarded with gift cards, encouraging more interaction.

“I liked learning about all the financial things I’ll need to know when I’m in college, Shayna Silvas-Thomas, 19, said.

Luisa Rivera, 15, liked learning more about the local credit union and how it differs from a bank. Zachary Guacheno, 14, said he learned a lot during the five weeks.

“I liked that the classes were so interactive; it kept my attention,” Leandro Silvas, 14, said. “I learned a lot of new things.”

During a class about developing a spending plan, Carter had students create a list of expenses from housing to food and necessary bills that their families incur. Added to that were things such as car notes and cell phone bills.

“I was surprised to learn how much our parents spend on us,” Iyana Briones said. Carter said that was an important revelation, reminding her and the others that eventually that will be them as they become heads of their own households.

Tribal Council is also exploring the idea of starting financial education classes for young adults, students at Noli Indian School at the Soboba Reservation and community adults. This recent pilot program was designed to gauge interest in specific topics and determine how viable and valuable such a course would be for different sectors of the Soboba community.

Carter said that for future courses, he plans to add a series of Consumer Classes such as How to make a Large Purchase, Consumer Psychology – Maslow’s Hierarchy of Needs and Retail Psychology that will focus on product placement in stores, why shelf space is like real estate, and guiding customer flow through a store. These topics are something everyone can relate to and learning about what is behind these business/retail decisions will help them make more informed consumer choices.

Photos courtesy of the Soboba Band of Luiseño Indians